Improvements in Web Visibility Empower Startup Sites

Traditional web analytics has fallen short in many ways that have frustrated web marketers who want more information and better ways to view it. For instance, the best web analytics packages show you information about:

- what your website's visitors do while on the site

- how visitors move through the pages of your site (although because this is done by URL this provides very little information about which link on a page triggered that movement)

- which pages and websites incoming visitors clicked in from

- general location and browser environment information, and

- conversions and where those visitors came from

All of this data is helpful in learning about your site and making changes in an effort to optimize your online content. It also helps you learn about your typical visitor profile and helps you understand how visitor behavior differs among the various channels you pull them in from.

But, a big gap remains between these details and the total picture of what your website visitors do online, not just on your website. Other very helpful details are typically not readily available including:

- Where your website visitors spend their time online

- What competitor websites your visitors surf to during the same online session that included their visitor to your website

- What paid search ads visitors click

- What keywords your visitors enter into searches that lead them to websites, and

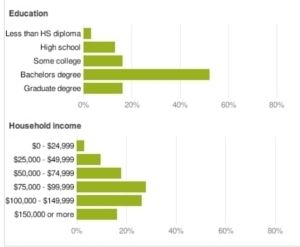

- Demographic information for the general population of visitors to your competitors' websites and websites that you might want to consider purchasing ad space on

This information has been available for a few years now among a fragmented set of information aggregators each with a different approach to information collection. The ones I'm aware of are as follows:

- Neilson: collects information from focus groups and individual user monitoring

- Compete.com: collects web activity information from 2 million online users and via surveys

- Alexa: collects information from the Alexa Score bar, and

- Hitwise: collects (and this one has always been my favorite, I want to know who negotiated these contracts) information anonymously from the logs of ISPs around the world

I have seen screen shots of the Hitwise offering as part of a presentation I attended at a Search Engine Strategies conference a few years back and I was blown away by type of information they can produce from the logs of ISPs. The information when brought together shows fascinating things about not only about how individual sites compete online but also general changes in Internet user behavior over time.

I am not as familiar with the Neilson product but have used Alexa and the similar Compete.com for a while now. Both contain interesting but not very actionable information. Neilson is often used by larger companies to guide media buying decisions. I don't know if Google's DoubleClick ad placement product has had anything built into it historically to provide this information although it should have... and it does now.

Enter Google (you probably guessed it). Last week they announced Google Ad Planner, shortly following a launch of Google Web Trends (similarly named to the popular web analytics product and company WebTrends) just a few weeks before as well.

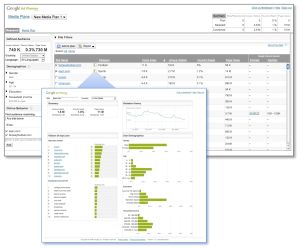

Google Ad Planner brings together information that Google has (Google's goal you might remember seems to be to have all of the information in the world at their disposal, and to make it available to you for free) collected from a number of sources. Although Google hasn't been very forthcoming about the sources of Ad Planner data we know they have information from the following assets in their possession:

- The Google Toolbar (more discussion about this is on TechCrunch)

- Organic search information

- Paid search including results-page CPC ads and display ads across their content network

- Gmail

- Google Analytics

Considering their search market share of 70%+ (source) and their broad install base of Google Toolbar (cannot easily find a reference to the number of Google Toolbar installs) this is likely an incredibly large slice of online user behavior data. If in fact they're using Gmail and Google Analytics data they're probably getting much higher quality information than the existing players because of the depth of behind-the-curtain details they can glean from website visitors who also use Gmail who are on websites that use Google Analytics.

That's the full backstage pass and Google has earned this position by creating compelling value propositions with both the Gmail and Google Analytics applications.

Google Ad Planner provides deep demographic and competitive site user session analysis where the complementing Google Web Trends product now allows you to track the popularity over time of websites as well as keywords (which they've supported for several years now). Google Web Trends also allows you to see a top-ten list of the following information for visitors to any website they track (only sites with pretty substantial traffic are available right now):

- visitor origin-country

- competitive sites from user sessions, and

- keyword searches performed

Many rumors exist for how Google will ultimately make these tools available but I think they're going to leave Google Web Trends free and available to anyone as it is now and the current invitation-only beta of Google Ad Planner will become available for free to anyone with a DoubleClick or AdSense account (possibly with a minimum monthly spend requirement).

This would only make sense as I don't think Google will want to mess with charging a monthly subscription fee and it would allow them to drive account acquisition among their two online advertising powerhouses. So, maybe now is a good time to get a DoubleClick or AdSense account if you don't have one, maybe there won't be a minimum spend requirement at all. Or maybe I'm completely wrong about all of this and you'll get one anyway.

One closing thought. The combination of Google Web Trends and Google Webmaster Tools and Google Analytics is a free triple-play of website competition tools that when used together (although they don't really integrate together) as part of a comprehensive web strategy will allow the small business to compete in awesome new ways. This value exists for businesses without any marketing budget to allow them to begin playing in AdSense, or later on, DoubleClick. The information these tools provide basically allows an entrepreneur to plug their brand new startup website into Google and receive automated feedback on:

- how well their online content is being understood by Google

- how that content is being found by relevant visitors

- what sites compete with them for this traffic

- how their visitors search for their competitors, and

- how much and what type of traffic they're receiving in comparison to their competitors.

After struggling to find this data for years it's now available through the collection of these tools in action together. Then, when the startup business begins to find success through content optimization and really starts to understand their online visitor profile, the combination of Google AdSense and DoubleClick and Google Ad Planner will allow them to target specific paid search (keywords used by competitive properties) and paid display ad opportunities (sites with similar visitor profiles) that match their preferred online audience and hit the right person with the right message... the web marketer's knockout punch, but it isn't free at this level.